If you produce a withdrawal in advance of age 59½ and before you decide to have held the account for 5 years, some of it might be subject to earnings tax in addition to a penalty.

If you create a monetary plan, insurance policies could be a critical facet of wealth management. Kinds of insurance that secure assets consist of:

There are quite a few gold and silver funds that investors have usage of currently, most of which can be acquired using common brokerage accounts.

Geopolitical exercise: Like pure activities, geopolitical action can effect the cost of precious metals. Political unrest, wars, shifts in political leadership and perhaps coverage alterations can all have much-reaching results out there.

A major threat with gold bars is they is usually stolen. They will also be tough to liquidate in more substantial dimensions. This implies traders have to think about the size of your bar—10 one-ounce bars are much easier to parcel and promote than just one 10-ounce bar—and wherever it is kept.

Investing in Gold and Silver Bullion Gold and silver are equally mined from deposits while in the earth’s crust. This Uncooked variety is then extracted and refined just before staying alloyed.

HELOC A HELOC can be a variable-rate line of credit that lets you borrow funds for any established period anonymous and repay them later on.

There are various methods you may go about investing in precious metals. This segment offers those particulars.

Junior mining shares are typically much more unstable than All those of main mining businesses, which are inclined to trace a lot more closely to metals price ranges centered on their own tested deposits. Big mining corporations are also much more likely to be able to pay dividends and see share price appreciation when metal charges are on an uptrend.

A different crucial stage in diversifying a portfolio is to invest some cash in fastened-cash flow assets like bonds.

Plans exist for workers, self-used individuals and modest-business people. Options in Each and every class let men and women to get fast tax deductions or put aside income for tax-cost-free withdrawals Down the road. The most effective retirement plans also offer you several investment options with lower fees.

Your employer may you can look here match a percentage of your contributions. That’s primarily no cost cash to spice up your savings.

Maryalene LaPonsie BLUEPRINT Maryalene LaPonsie continues to be crafting skillfully for virtually twenty five decades and focuses primarily on personalized finance, retirement, investing and training subjects.

A lot of people fully grasp the value of having income set aside for retirement, but it surely will not be apparent why you ought to use a retirement plan. In spite of everything, you may invest The cash in a daily brokerage account, place it in certificates of deposit or go away it inside your savings account.

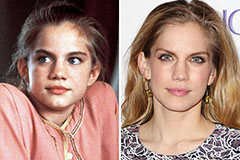

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Josh Saviano Then & Now!

Josh Saviano Then & Now! Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now!